Shinhan completes review of stablecoin cross-border transfer technology

(Shinhan Bank)

South Korea’s Shinhan Bank said on Nov. 30 that it has completed its review of its cross-border wiring and transfer technology for stablecoins, but remained cautious on its actual adoption.

Stablecoins are a form of cryptocurrency designed to have a stable value tied to traditional government-backed currencies, or to a commodity such as gold, to dodge the volatilities of Bitcoin and other cryptocurrencies.

“With the stablecoin transactions growing overseas, including JP Morgan’s JPM Coin, we felt the need to review a key related technology to keep pace with the global market and the cross-border transactions service was our first choice,” a Shinhan official said.

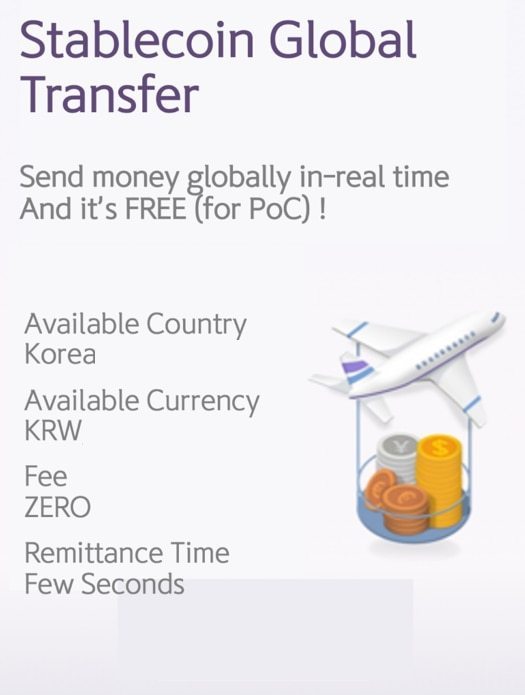

While cross-border cash wiring requires another financial institution as a mediator, around $20 in transaction fees and takes at least two days to complete, a stablecoin transfer is much simpler, Shinhan noted. The stablecoin transaction fee is free, so the user only needs to pay a blockchain network fee of less than 100 won ($0.08) each time, and the process takes about 35 seconds.

But Shinhan remained cautious on its actual adoption, saying the wiring service, including the cross-border technology, will be launched after reviewing related frameworks and laws.

Shinhan’s latest move marks a first for a local financial institution in the development of a stablecoin-related technology.

Shinhan announced earlier this month it was preparing to launch its own won-backed stablecoin. The bank plans to ultimately enable the usage of stablecoins in its metaverse platforms, which is also a key project.

South Korea has yet to erect a solid framework for stablecoins. In the US, regulators have recently expressed their wish to slap bank-like rules on the assets, with the issue of whether it should be issued by only insured depository institutions remaining on the table.

Shinhan Bank’s third-quarter net profit gained 21.6 percent on-year to 759.3 billion won, according to a regulatory filing.

By Jung Min-kyung (mkjung@heraldcorp.com)

EDITOR'S PICKS

- Nexon expands game pipeline to target global market

- Samsung SDI-Stellantis JV to start US production in December

- LG Innotek develops industry's first rare earth-free magnet

- SK Networks teams up with Malaysia’s Sunway in AI push

- KGC launches new ginseng brand for blood sugar care

- Toss eyes Nasdaq debut

- Hanwoo Day promotion offers up to 50% off Korean beef

- LG Chem ups automotive adhesives business