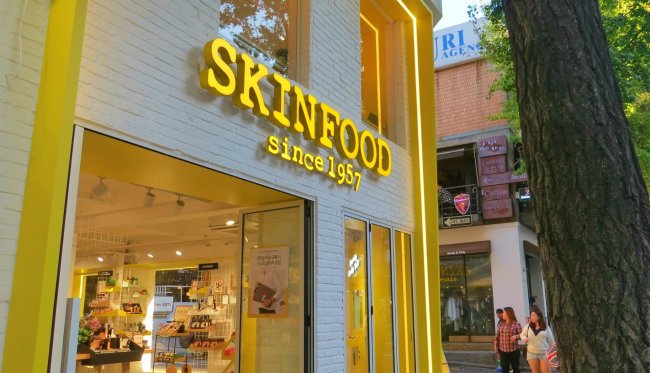

Fate of SKINFOOD hanging in balance?

[THE INVESTOR] Speculation has been spiking that Korean budget cosmetics brand SKINFOOD may be closing its doors.

Empty shelves at one outlet appeared to be the proof. “It’s been quite a while, maybe over half a year, since we last received supplies,” a SKINFOOD franchise owner told The Investor on July 2. Popular items like Choco Eyebrow Powder Cake and Peach Cotton Pore Sun Pact were all out of stock. “Today, the headquarters sent us an official statement saying that they will supply us as soon as they can.”

Related:

SKINFOOD enters UK via drugstore chain Boots

SKINFOOD, however, vehemently denied that its business was going down the drain. “The supply shortage is due to multiple reasons, some of it being a delay in raw material supplies and also sudden surges in sales for certain items,” a spokesperson told The Investor, declining to be identified.

While it may not be closing down, signs indicate that there is no denying its business is suffering. From the mid-2000s, the budget cosmetics brand market grew amid a rise in the global popularity of K-pop and Korean beauty items. SKINFOOD was one of the brands that benefited most from this trend. In 2010, it ranked as one of the top three budget beauty brands here, with sales reaching 164.2 billion won (US$147.3 million).

According to sources, however, SKINFOOD has been losing money since 2014. The company’s sales dropped 25 percent from 169 billion won to 126.9 billion won on-year in 2017, while its operating losses reached 1 billion won. The company’s debt ratio also increased more than threefold in 2017 from 257.2 percent to 781 percent. Additionally, a report published by Anse accounting firm last year said, “SKINFOOD has to be watched closely because it has some uncertainties that can make its ability to survive questionable.” Following are the reasons behind SKINFOOD’s decline.

Collapse of the ‘no-sales’ policy

SKINFOOD originally advertised that because it uses “natural” materials, it would stick strictly to a certain policy.

The Korean cosmetics firm said it would focus on providing quality products instead of competing to offer lower prices than other companies.

This strategy, however, has failed. The company’s sales dropped from 185 billion won in 2012 to 174 billion won in 2013. Its operating profits during the same period fell from 11.4 billion won to 3.1 billion won, while its competitors saw rising revenues.

Sales of Able C&C’s Missha in 2015 reached 407.9 billion won, increasing from 118.1 billion won in 2009. At the beginning of 2015, SKINFOOD abandoned its unique no-sales policy to boost turnover, but the market had already become saturated by then.

Changing trends

SKINFOOD is not the only budget cosmetics brand having difficulties these days. All budget brands are losing market share to health and beauty stores, which sell different budget cosmetics brands from one location. The size of the H&B store market grew from 300 billion won to over 1 trillion won in the recent seven-year period.

Top H&B store Olive Young, operated by CJ Olive Networks, currently has more than 950 outlets here and is on the rise. The number of SKINFOOD stores, however, fell in 2017 to 580 from 590 a year before. Missha, which had 733 stores in 2016, also closed more than 30 stores last year.

A high dependency on the Chinese market was another trend these brands were counting on. When the “THAAD row” broke out, it spelled doom. In fact, SKINFOOD Shanghai sales are no longer accounted for.

Glimmer of hope

The good news for SKINFOOD is that the global popularity of Korean beauty items remains strong. Not only are there many interested individual customers, global beauty giants like L’Oreal have also recently showed interest in Korean budget brands.

This is why the company also added that it is expecting to see some profit from the overseas market in the near future. “As our business in Korea gets difficult due to the competition, we see our future lying in markets like the US and China. We are also planning to further expand into Southeast Asian countries,” said a SKINFOOD spokesperson.

The firm started retailing its products in the US through cosmetics store Ulta Beauty from 2016, and has recently seen some operating profit.

By Song Seung-hyun (ssh@heraldcorp.com)

EDITOR'S PICKS

- Korea’s top finance firms put aside W1.7tr for Hong Kong-tied ELS compensation

- Samsung mobile chief, Google device head meet in Seoul

- Posco Future M, Honda to launch battery materials venture in Canada

- Hybe-Ador feud should have limited effect on Hybe's overall performance: analysts

- Experts raise concerns about Japan putting pressure on Naver over Line

- SK hynix profits soar on AI chip boom

- Korea enters clear growth path as Q1 growth hits 2-year high

- Hyundai, Kia seek to boost presence in China market