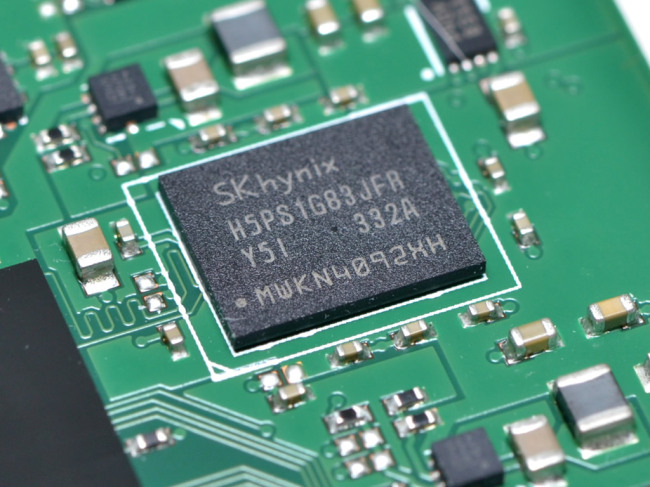

Uncertainty heightens over SK hynix's bid in Toshiba deal

[THE INVESTOR] Uncertainty mounted over South Korea-based SK hynix’s bid in the ongoing Toshiba sale on July 16 with unverifiable claims swirling around that the Korean memory chipmaker has already given up on acquiring a stake in the Japanese firm’s flash memory unit.

Since a global consortium of US private equity firm Bain Capital, two state-backed Japanese financial institutions and SK hynix, the preferred bidder, failed to ink a US$18 billion deal on purchasing the NAND flash memory unit of Toshiba on June 28, suspicions have continuously been raised that the deal is going nowhere.

The suspicions peaked on July 16 as a Japanese news agency reported SK hynix gave up on its acquisition of a stake guaranteeing a voting right for Toshiba, which was strongly denied by sources familiar with the matter.

“Considering the ongoing talks, such reports sound false or exaggerated,” said a source requesting anonymity. “Some related parties are seemingly using the media to lead the deal to a direction they want.”

SK hynix officials, meanwhile, declined to comment regarding the issue.

SK hynix’s official stance on the Toshiba deal remains aligned with its CEO Park Sung-wook’s remarks made on July 12.

To a question of the possible surrender of SK hynix’s bid to win a Toshiba stake, Park told reporters, “The company is not considering the option at all, and is still talking (with Toshiba) to acquire a stake.”

Some speculate that the talks between Bain-led consortium and Toshiba fell into a deadlock on June 28, because of SK’s proposal to fund the deal through convertible bonds worth about US$4.6 billion, which is deemed a step that could eventually give SK hynix an equity interest in Toshiba. The US$4.6 billion is about a fourth of the total purchase value.

Toshiba and Japanese government authorities still want to keep the company’s technologies under domestic control, protecting them from Asian rivals such as SK hynix and Taiwan’s Foxconn.

“If the speculation turns out to be true, SK’s withdrawal from the bid may help break through the stalled negotiations,” said an industrial insider.

One of reasons that the consortium couldn’t sign the deal last month was a serious disruption by rival US-based Western Digital, a long-time partner of Toshiba.

Following Toshiba’s pick of the preferred bidder, the US chipmaker sued its Japanese partner with a San Francisco court, asking the court to order an injunction to stop the current sale of the flash memory unit and a temporary restraining order forcing Toshiba to give its workers access to shared databases.

The US court gave Western Digital access to Toshiba’s databases last Wednesday, but postponed its decision on the injunction to stop the sale.

Western Digital is back in talks with Toshiba about the sale, according to Reuters.

By Song Su-hyun/The Korea Herald (song@heraldcorp.om)

EDITOR'S PICKS

- Korea’s top finance firms put aside W1.7tr for Hong Kong-tied ELS compensation

- Samsung mobile chief, Google device head meet in Seoul

- Posco Future M, Honda to launch battery materials venture in Canada

- Hybe-Ador feud should have limited effect on Hybe's overall performance: analysts

- Experts raise concerns about Japan putting pressure on Naver over Line

- SK hynix profits soar on AI chip boom

- Korea enters clear growth path as Q1 growth hits 2-year high

- Hyundai, Kia seek to boost presence in China market