Hyundai, rival carmakers urge US to delay Chinese tech ban

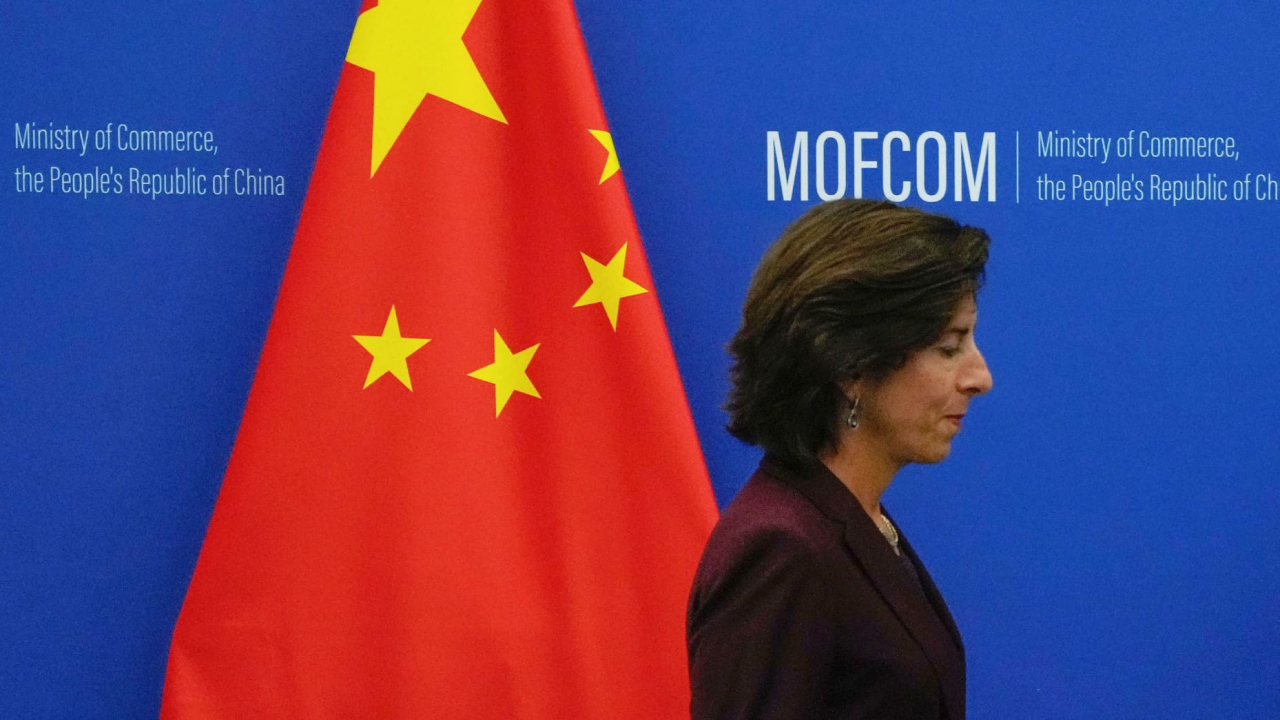

US secretary of Commerce Gina Raimondo arrives in Beijing for talks with Chinese Minister of Commerce Wang Wentao in August last year. (Newsis)

Global automakers, including Hyundai Motor, Toyota and General Motors, are urging the US government to delay new restrictions on Chinese-made parts used in connected vehicles.

The proposed regulations, which aim to limit Chinese and Russian components in vehicles with advanced communication and autonomous driving features, are raising concerns not only among automakers but also from Mexico, where many companies affected by the rules have invested in production facilities.

According to Reuters on Tuesday, The Alliance for Automotive Innovation, a major US auto industry group representing companies like Hyundai, Toyota, GM and Volkswagen, has requested at least a one-year delay in implementing the regulations, which are set to phase over the next decade.

AAI President John Bozzella said in a statement that while some manufacturers may be able to comply with the US Department of Commerce’s new rules on Chinese-made parts, the timeline could be “too short” for many to adapt their supply chains effectively.

The US Department of Commerce announced the proposed regulations in September. Starting with the 2027 model year, the rules would ban any cars sold in the US that use software made in China or Russia for features like navigation, vehicle communication or autonomous driving. For hardware components, the ban would begin with 2030 models. For cars without a specific model year, like some commercial vehicles, Chinese and Russian parts will be off-limits starting in 2029.

US officials are concerned that Chinese technology in connected vehicles could give foreign entities access to sensitive data on American drivers, including location, routes and in-car conversations. The ban would apply to most modern cars, which are increasingly equipped with navigation and wireless communication software. This could even impact US-made vehicles if they use restricted parts, meaning automakers may need to overhaul their supply chains.

The Mexican government has joined automakers in voicing concerns over the proposed rules. In a formal response to the US Department of Commerce, Mexico argued that the restrictions could have a “significant impact” on its auto industry, which has seen an influx of investment as global automakers shift production to Mexico.

Mexico’s concerns about these restrictions also come amid a wave of new investment from Chinese automakers, who see Mexico as an attractive production base. With US-China trade tensions still high, Chinese car brands like BYD, Great Wall Motor, Geely and MG have announced plans to set up or expand factories in Mexico.

In April, South Korean officials and auto industry representatives warned the US government that the broad scope of the restrictions and the lack of clarity around affected components could create significant logistical and financial challenges for Korean automakers.

The US Department of Commerce has not yet responded to requests for a delay. It plans to finalize the rule by Jan. 20 next year, after a period of public comments and industry feedback.

By Moon Joon-hyun (mjh@heraldcorp.com)

EDITOR'S PICKS

- Busan adding longer-haul flights with Bali route to start Wednesday

- AmCham, KITA host seminar on doing business in US

- [KH Explains] How LG Energy Solution’s bold bet paid off with Tesla, Mercedes deals

- Seminar stresses arbitration's role in ending private equity disputes

- Hyundai, rival carmakers urge US to delay Chinese tech ban

- Hanon Systems to build 1st electric compressor plant in North America

- Hankook Tire uses carbon black for sustainable production

- Asia-Pacific tax chiefs gather in Seoul to bolster cooperation

![[KH Explains] How LG Energy Solution’s bold bet paid off with Tesla, Mercedes deals](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=141&simg=/content/image/2024/10/29/20241029050614_0.jpg)