Korea’s current account surplus narrows in March

South Korea’s monthly current account surplus narrowed in March from a year earlier amid slowing exports, central bank data showed May 8.

The country’s current account surplus came to $4.8 billion in March, down from $5.1 billion a year earlier, according to the preliminary data from the Bank of Korea. But the surplus widened from the previous month’s $3.6 billion.

The current account has been in the black for 83 straight months.

In the first three months of this year, the country’s current account surplus stood at $11.2 billion, marking the smallest surplus on a quarterly basis since the second quarter of 2012, the data showed.

The country’s outbound shipments fell 3.9 percent on-year to $137.5 billion in the January-March period, marking the first quarterly decline in exports since the third quarter of 2016.

Korea’s exports also fell 2 percent in April from a year earlier, extending their on-year fall for the fifth consecutive month due to a drawn-out slump in chips and weak demand from China.

The goods account surplus fell to $8.4 billion in March from $9.4 billion a year earlier due to a drop in exports amid slowing demand for semiconductors and petrochemical goods.

The BOK attributed a decline in the goods account to a fall in world trade volumes, weaker chip prices and China’s economic slowdown.

The services account deficit slightly widened to $2.3 billion from a deficit of $2.2 billion a year earlier.

“Despite a steady rise in the travel account, the services account deficit widened due to a deficit in the intellectual property account,” the BOK said.

The primary income account deficit narrowed to $740 million in March from $1.3 billion a year ago, in line with a decrease in the payment of dividends, the BOK said.

By Ram Garikipati and newswires (ram@heraldcorp.com)

EDITOR'S PICKS

- [From the Scene] KG Mobility poised to take next leap

- Samsung Biologics Q1 earnings hit all-time high

- KGC eyes broader customer base with Lim Young-woong

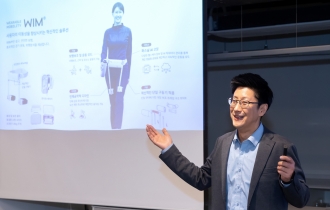

- Korean robot startup aims to transform human walking

- Coway launches Berex massage bed with enhanced usability

- Hyundai Mobis breaks ground for W170b Spain plant

- HD Hyundai teams up with Norway's Philly Shipyard for US footing

- Hanwha Life taps into global banking through Indonesian investment

![[From the Scene] KG Mobility poised to take next leap](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=141&simg=/content/image/2024/04/24/20240424050621_0.jpg)