Woori Bank strengthens anti-money laundering surveillance system

Woori Bank has established a strengthened anti-money laundering surveillance system whose protocols are on par with global standards to fight financial crime and strengthen compliance, the bank said on April 28.

Woori said it has become the first commercial bank in Korea to adopt an anti-money laundering system that meets the standards of the Financial Action Task Force. FATF is a global standard-setting body to fight money laundering and finance terrorism of which South Korea is a member.

In strengthening its AML surveillance capabilities, Woori said it has promoted its existing AML team to a higher status within the organization and tripled the number of specialized surveillance employees from 36 to 110. The bank also expanded its internal compliance department to a bigger unit.

With the support of local financial regulators, Woori Bank has also established a three-step risk management system to prepare for money laundering-related risks and issues.

All of the bank’s main business groups now have a “know your customer” team in charge of identifying the nature of customers’ financial dealings and potential risks they bring to the bank’s business relations, it said.

Looking ahead, Woori Bank plans to continue working with outside experts to further improve its anti-money laundering surveillance capabilities and nurture experts in this field.

Woori Bank’s moves come in preparation for stricter AML regulatory stipulations proposed by the FATF, which Korea’s financial regulators are also preparing to adopt.

Money laundering refers to the process of concealing the source of illegally obtained money by putting it through a series of transactions to disguise its illicit origins and make it appear to be tied to legitimate accounts.

The process typically comes in three stages: placement, whereby illicit money is introduced into the financial system by some means; layering, complex financial transactions to conceal the source of the illicit source; and integration, where problematic funds are integrated into legitimate funds to give the appearance of having been legally obtained.

By Sohn Ji-young/The Korea Herald (jys@heraldcorp.com)

EDITOR'S PICKS

- US confirms $6.4 billion chip subsidy for Samsung

- How should Korea adjust its trade defenses against Chinese EVs?

- Korea braces for blows from Middle East conflict

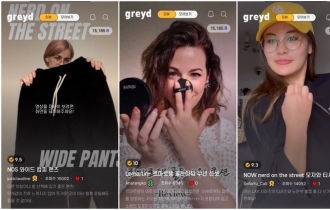

- Greyd’s video platform helps Korean sellers go global

- Samsung, LG showcase built-in lineup at Milan Design Week

- Hanlim, Kazakhstan partner on greenhouse gas reduction project

- BMW purchases over $4.7b Korea-made parts in 2023

- LG Uplus chief lures AI talent in Silicon Valley