Major S. Korean financial groups’ dividends top W2.5tr

The total cash dividends of South Korea’s four major financial groups topped 2.5 trillion won ($2.23 billion) in 2018, according to reports on March 10.

KB Financial, Shinhan Financial, Woori Financial and Hana Financial handed out a combined 2.52 trillion won in dividends to their shareholders last year, up 2.3 trillion won or 8.8 percent from the previous year.

The amount also marked a 157.3 percent jump from 979.9 billion won paid out in 2011, when the industry had just rebounded after the 2008 global financial crisis.

The record-high dividend payout was backed by their improved annual net profits.

The combined annual net profit of the four groups reached nearly 10.5 trillion won last year, up 18.9 percent from 2011, which boosted the average dividend payout ratio to 24 percent from 11.1 percent during the same period.

“Market watchers forecast that the payout ratio would decline due to the financial regulator’s tightened capital adequacy ratio requirements, but the latest results show that (they) accommodated shareholders’ demands amid their improved business performance,” said Kim Soo-hyun, analyst at Shinhan Financial Investment.

KB Financial had the highest dividend payout, at 759.7 billion won, or 24.8 percent of its net profit. Shinhan Financial came second with 753 billion won, or 23.9 percent, while Hana Financial and Woori Financial followed with 570.5 billion won and 25.5 percent, 437.6 billion won and 21.5 percent, respectively.

Industry watchers noted that the financial groups made their decisions based on their respective management priorities for this year -- boosting their stock value by appealing to shareholders or securing funds for business expansion.

Woori Financial, which recently vowed to actively pursue strategic mergers and acquisitions in the nonbanking sector, has lowered its dividend propensity to secure capital.

Hana Financial, on the other hand, has increased its dividend payout rate by 3 percent on-year, to attract more investors after a downward trend last year.

Some observers, however, expressed concerns over capital outflow, pointing out the relatively high proportion of foreign shareholders in Korea’s financial companies.

As of March 8, the foreign shareholder ratio at KB Financial, Shinhan Financial, and Hana Financial stood at 66.45 percent, 67.18 percent and 69.93 percent, respectively.

By Jung Min-kyung/The Korea Herald (mkjung@heraldcorp.com)

EDITOR'S PICKS

- KGC eyes broader customer base with Lim Young-woong

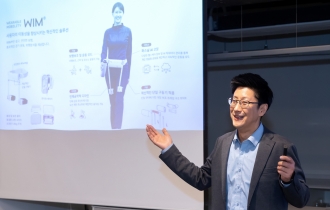

- Korean robot startup aims to transform human walking

- Coway launches Berex massage bed with enhanced usability

- Hyundai Mobis breaks ground for W170b Spain plant

- HD Hyundai teams up with Norway's Philly Shipyard for US footing

- Hanwha Life taps into global banking through Indonesian investment

- LG Energy Solution vows stern action to protect patent rights

- Hyundai unveils versatile commercial EV platform