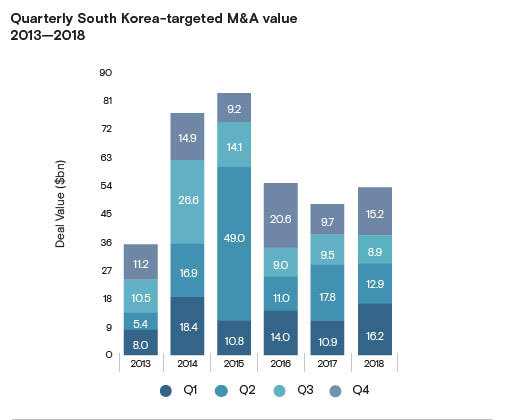

Korea sees rebound in M&As in 2018

[THE INVESTOR] Korea’s merger and acquisition deals in 2018 have turned around after two consecutive years of a pullback, amounting to US$53.1 billion, according to data and intelligence provider Mergermarket on Jan. 16.

The Korean M&A market recorded 449 deals, which was the highest number in its database since 2001.

“The local market had an active year as conglomerates were accelerating restructuring to finalize holding company structures and complying with regulatory restrictions over intra-group transactions put forth by the Korea Fair Trade Commission,” Mergermarket said in a report.

The manufacturing and chemicals sectors were the most dominant in terms of both deal value and numbers, with 122 deals worth US$12.8 billion, the agency said. The second-largest Korean targeted deal of the year -- acquisition of Siren Holdings Korea by SK Telecom and a consortium led by Macquarie Infrastructure and Real Assets from The Carlyle Group for US$2.7 billion -- accounted for 21.5 percent of sector activity. Technology was the second-most dominant sector, with US$8.2 billion recorded for 81 deals.

Investment headed to Asia’s fourth-largest economy last year was fueled by two consecutive on-year increases, which reached US$9.9 billion across 48 deals, the second-highest in terms of deal value. The undisclosed stake acquisition of Coupang by SoftBank Group for US$2 billion ranked as the top inbound deal, which contributed heavily in terms of total M&A activity, accounting for more than 20 percent.

The biggest deal last year was the merger of two units of the country’s largest media conglomerate CJ Group -- CJ O Shopping, a major TV home-shopping network, and CJ E&M -- which became CJ ENM, valued at US$3.9 billion.

By Park Ga-young (gypark@heraldcorp.com)

EDITOR'S PICKS

- KGC eyes broader customer base with Lim Young-woong

- Korean robot startup aims to transform human walking

- Coway launches Berex massage bed with enhanced usability

- Hyundai Mobis breaks ground for W170b Spain plant

- HD Hyundai teams up with Norway's Philly Shipyard for US footing

- Hanwha Life taps into global banking through Indonesian investment

- LG Energy Solution vows stern action to protect patent rights

- Hyundai unveils versatile commercial EV platform