Secrets of building a successful fintech firm

[THE INVESTOR] In recent years, the advancement of technology has pushed the financial sector to transform. With non-banks stepping up to lead the payment world and all parts of financial services, the competition has become fierce between new players and traditional institutions, all vying to take a slice of the fast-changing industry.

What are the secrets of success in this ever-changing fintech era? There are four aspects, according to Ron Kalifa, vice chairman of Worldpay, a London-based payment firm that processes more than 40 billion transactions across 146 countries.

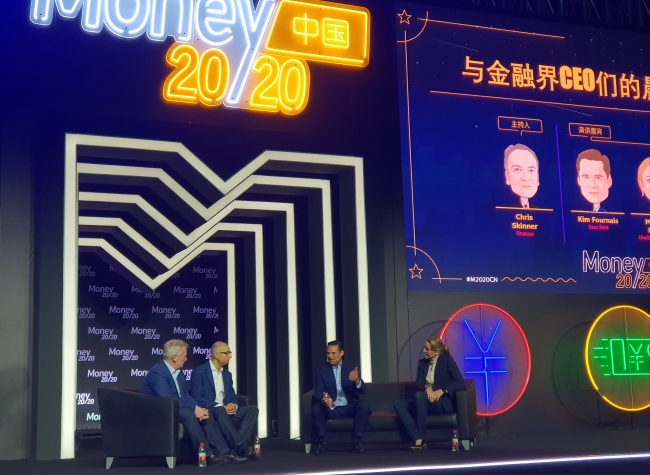

(From left) Moderator Chris Skinner, author and commentator at Finanser; Ron Kalifa, vice chairman of Worldpay; Kim Fournais, co-founder and CEO of Saxo Bank; and Michelle Prance, head of innovation & strategy at Lloyds Banking Group.

“First, you need to have a business model that can get to scale,” Kalifa said during a CEO panel session at Money 20/20 China on Nov. 15, the world’s largest fintech and payment conference that made its debut the previous day.

“Second is distribution. How do you access distribution to get customers and ensure a continuing pipeline for different types of distribution? Third is around regulations. We are working and living in a regulated environment, and we need a license to operate. The last is technology, which enables the future.”

Other leaders from financial institutions stressed the importance of partnerships to meet customer demands to stay competitive against emerging fintech firms.

“New players and technologies are changing everything,” said Kim Fournais, co-founder and CEO of Saxo Bank, a Danish investment bank. “At the same time, margins are coming down, making it harder to pay the bills. Even the biggest financial institutions of this world can’t do everything for everyone. So it’s about specialization and building partnerships to move forward.”

“What we are seeing in fintech is that it is pushing the boundaries of what customers are expecting,” said Michelle Prance, head of innovation & strategy at Lloyds Banking Group, Britain’s major financial institution with 250 years of history. “Speed of change and the personalization are some of the things fintech firms are able to offer, which are things we can either compete with or integrate in our service.”

On the dramatic pace of changes in the financial industry, leaders identified keeping up with regulations, cybersecurity and scaling to reach more customers, among others, as major concerns.

“Regulation is a term considered negative and simply feels like a constraint. But regulations are an opportunity as well,” said Kalifa. “We got to make sure that we are the custodians for our customers from the regulatory point of view. One of the tasks of any company is to work with regulators, whether it is partnership or in terms of explaining your business model. The business model is changing everyday and our task is to make sure we stay current and the regulators stay current.”

The Chinese chapter of Money 20/20 runs through Nov. 16 at the Hangzhou International Expo Center.

By Ahn Sung-mi (sahn@heraldcorp.com)

EDITOR'S PICKS

- Seoul shares rattled by Israeli attack on Iran; Kospi dips to nearly 11-week low

- S-Oil donates W560m to support firefighters

- LG CNS teams up with Yonsei University to nurture AI specialists

- Polestar 4 to make Korean debut in June

- S. Korea pledges W23tr venture capital fund for green investment at G20 meeting

- Sungsimdang outperforms bakery giants to log sales over W100b

- France rejects opening Paris flight routes to T'way Air, deals blow to Korean Air merger

- SK hynix chief underscores chip cooperation between Korea, US