[EQUITIES] ‘KEPCO lacks momentum’

[THE INVESTOR] Korea Electric Power Corp.’s current stock price is undervalued at 0.22 times its price-to-book ratio but it needs to gain momentum, said Hana Financial Investment on Oct. 12 lowering the target price to 33,000 won (US$29.07) from 39,000 won.

Its revenue in the third quarter will remain flat at 16.2 trillion won, as rise in sales has offset easing of progressive rate for household use, but operating profit will plunge 65.6 percent on-year to 954.9 billion won, said analyst Yoo Jae-seon.

Its nuclear power plant usage gained 4 percent from the same period to 74 percent but surge in demand in the peak season and double-digit fuel cost rise will inevitably cut down profits. Nuclear power plant usage rate will recover up to mid-80 percent next year and unless the raw material price hikes or exchange rate turns significantly unfavorable, it will manage to turn to black, added the analyst, maintaining a “buy” recommendation.

By Hwang You-mee (glamazon@heraldcorp.com)

EDITOR'S PICKS

- KGC eyes broader customer base with Lim Young-woong

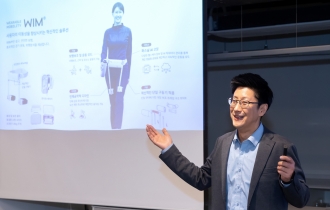

- Korean robot startup aims to transform human walking

- Coway launches Berex massage bed with enhanced usability

- Hyundai Mobis breaks ground for W170b Spain plant

- HD Hyundai teams up with Norway's Philly Shipyard for US footing

- Hanwha Life taps into global banking through Indonesian investment

- LG Energy Solution vows stern action to protect patent rights

- Hyundai unveils versatile commercial EV platform