Delisting of Chinese firms in Korea costs investors W270b

[THE INVESTOR] The losses incurred due to the involuntary delisting of Chinese companies amounted to 270 billion won (US$236 million), a lawmaker said on Oct. 11.

According to ruling Minjoo Party lawmaker Kim Byung-wook, a total of 23 Chinese firms including four on the main bourse KOSPI got listed on Korean stock exchanges since 2007 and 10 of them have been removed so far. Six were delisted amid frequent accounting irregularities such as fabricating disclosures and accounting fraud while four voluntarily left.

Among the companies that were kicked out -- four KOSPI-listed companies and two KOSDAQ firms -- five received audit disclaimers.

The delisting of three companies -- China Ocean Resources, Shenglong Solar and China Gaoxian Fibre Fabric Holdings -- has each resulted in more than 70 billion won in damages for investors. Wanli International Holdings, one of the top wall tile makers in China which was booted out in 2017, incurred 32.3 billion worth losses, data from the lawmaker showed.

This estimates are expected to balloon once China Haoran Recycling, which is on the verge of delisting for violating disclosure norms, is ousted by the first quarter of 2019.

Investors blamed Korea Exchange, the country’s stock market operator, and IPO managers.

Following the criticism, KRX strengthened requirements for Chinese companies to protect investors earlier this year. Some industry watchers and investors, however, said the role of IPO managers is even more important to prevent the massive delisting of Chinese companies.

“Brokerages are to blame first. They were blinded by bigger commissions they could make by listing these companies and by the potential growth of the Chinese economy,” an investor who wished to remain anonymous said.

Four of the Chinese companies on the primary KOSPI market, whose IPO managers were leading brokerages -- then Daewoo Securities (now Mirae Asset Daewoo) and Hyundai Securities (now KB Securities) -- got delisted.

“The most important reason is that securities companies are not equipped with a system to select good companies for listing and they were just too enthusiastic,” said Hwang Sei-woon, head of capital market division of Korea Capital Market Institute.

“The government should come up with alternative measures such as urging brokerages firms to conduct a thorough on-site due diligence of Chinese companies so that the listing of insolvent companies can be prevented in advance,” Rep. Kim said.

By Park Ga-young (gypark@heraldcorp.com)

EDITOR'S PICKS

- KGC eyes broader customer base with Lim Young-woong

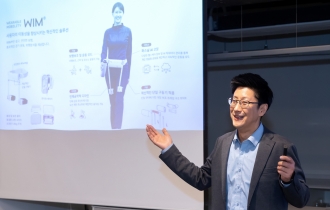

- Korean robot startup aims to transform human walking

- Coway launches Berex massage bed with enhanced usability

- Hyundai Mobis breaks ground for W170b Spain plant

- HD Hyundai teams up with Norway's Philly Shipyard for US footing

- Hanwha Life taps into global banking through Indonesian investment

- LG Energy Solution vows stern action to protect patent rights

- Hyundai unveils versatile commercial EV platform