Samsung aims to revitalize Chinese smartphone biz with Note 9

[THE INVESTOR] Samsung Electronics showcased the Galaxy Note 9 on Aug. 15 in China where the company is trying to reinvigorate its struggling smartphone business.

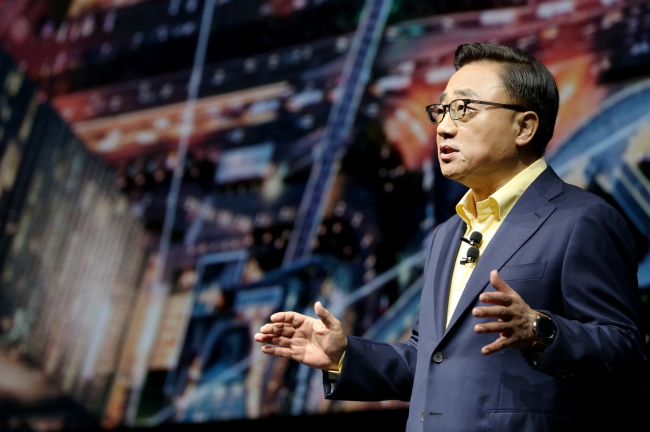

“Samsung is trying to regain consumers’ trust and cater to the needs of local users by bringing changes to all of its business processes from design and sales to marketing,” said Koh Dong-jin, CEO of the tech company’s mobile division during the Chinese media event, which was held after it first took the wraps off the latest flagship in New York and Korea last week.

Koh Dong-jin, the CEO of Samsung's mobile division.

Related:

Samsung pushes the envelope with Galaxy Note 9

Around 300 reporters, consumers and influencers took part in the Chinese event held at the Shanghai 1862 Theater art center, according to the company.

China is one of the most lucrative smartphone markets in the world with the number of smartphone users there reportedly surpassing 717 million -- more than triple that of the US.

Samsung, which used to be the top smartphone manufacturer in China, however, has seen its market share fall recently due to the rise of Chinese competitors including Huawei, Oppo and Xiaomi.

Since Samsung’s market share in China reached its peak, at 19.7 percent, in 2013, the figure has been spiraling down: 13.8 percent in 2014, 7.6 percent in 2015, and 4.9 percent in 2016, according to market research firm Strategy Analytics. In the second quarter this year, the market share hit a record low of 0.8 percent in China.

The second-quarter market share was especially disappointing for Samsung, which had pinned high hopes on the Galaxy S9, a flagship smartphone released in the first quarter this year.

In a recent press conference held in New York after the unveiling event, Koh admitted that Samsung’s smartphone business in China is indeed “in trouble,” but vowed to expand its presence in the coming years.

“Samsung is seeing some positive market signals in China,” said the CEO, adding “It is a market we can never give up on, considering the market size.”

The company had tapped Executive Vice President Kwon Gye-hyun, a seasoned overseas sales and marketing expert, in early 2017 to head the Chinese operations while streamlining its seven sales offices into one.

The Samsung CEO also said the company would try to beef up the mid-range and low-end smartphone lineups by adopting some of its new technologies into the smartphones falling into the categories before the top-tier devices.

Some market researchers have pointed out that Samsung’s strategy to put more focus on high-end smartphones than mid-range and low-end devices undermined the overall sales of its global smartphone business.

Among the major top seven smartphone makers, including Apple and Hauwei, Samsung was the only company that saw the average selling price, which reflects the profitability of a product, drop during the second quarter this year, according to a report recently released by research firm Counterpoint Research.

Samsung’s ASP dropped to US$247 in the second quarter this year, down 8 percent from a year earlier.

Apple’s ASP, on the other hand, stood at US$724, up 20 percent during the same period while Oppo and Huawei saw their ASP increase 17 percent and 21 percent to US$275 and US$265, repectively.

By Kim Young-won (wone0102@heraldcorp.com)

EDITOR'S PICKS

- SK hynix chief underscores chip cooperation between Korea, US

- Trilateral talks acknowledge ‘serious’ slumps of won, yen

- Samsung C&T president makes her first business trip to Milan

- Seoul Business Agency CEO says SNS marketing essential for SME

- CJ Olive Young offers real-time translators for foreign visitors

- Hyundai Motor, Toray join hands for material innovation in mobility

- Paris Baguette debuts in the Philippines

- Samsung develops fastest DRAM chip optimzied for ondevice AI