CJ considers IPO of Schwan’s after acquisition: report

[THE INVESTOR] CJ CheilJedang is considering an initial public offering of Schwan’s Co., the US food processor that it is seeking to acquire for a whopping 3 trillion won (US$2.80 billion), according to The Bell on June 21.

The report said the IPO is aimed at attracting financial investors like private equity firms to join the bid -- the largest-ever purchase by the Korean food giant.

Related:

CJ out to acquire US food processor Schwan’s

The firm recently participated in a preliminary bid to acquire a sizeable stake in the Minnesota-based food company. Other bidders reportedly include Thailand’s Charoen Pokphand Foods.

Even though CJ CheilJedang secured 1.3 trillion won cash after selling off its pharmaceutical unit CJ Healthcare in April, the report said, it seems unavoidable for it to secure more cash to win the mega deal. Morgan Stanley is the deal advisor.

Korean conglomerates usually seek a deal by creating a consortium among their own affiliates, but the report said CJ CheilJedang is more likely to join hands with outside investors. Last year when the firm acquired Brazilian soy protein maker Selecta, Stic Investment, a Seoul-based PEF, shouldered half the price or 150 billion won.

Since the possible acquisition was confirmed last week, the firm’s share price has increased more than 4 percent on expectations about its business expansion in the US.

By Lee Ji-yoon (jylee@heraldcorp.com)

EDITOR'S PICKS

- KGC eyes broader customer base with Lim Young-woong

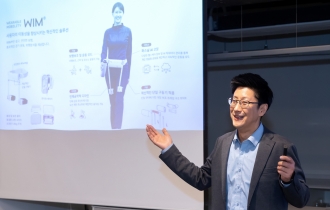

- Korean robot startup aims to transform human walking

- Coway launches Berex massage bed with enhanced usability

- Hyundai Mobis breaks ground for W170b Spain plant

- HD Hyundai teams up with Norway's Philly Shipyard for US footing

- Hanwha Life taps into global banking through Indonesian investment

- LG Energy Solution vows stern action to protect patent rights

- Hyundai unveils versatile commercial EV platform