‘Out with the old’ comes with hefty price tag for Korean chaebol

[THE INVESTOR] It’s a case of “out with the old, in with the new” for Korean conglomerates as the older leaders are preparing to hand over their crowns.

But before this happens, inheritance taxes must be paid, and the amount is rumored to be quite hefty, as the government takes away half the inheritance worth 3 billion won (US$2.77 million) or more. For stocks, taxes are levied based on the average share price during the two months before and after the day of death.

“A 50-percent tax rate could be an immense financial burden on conglomerates and owner families,” said a market watcher on condition of anonymity.

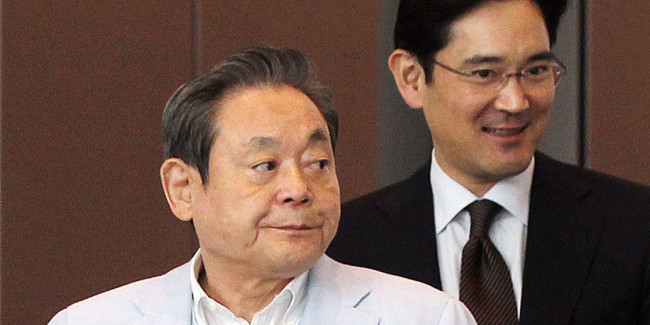

Samsung Group Chairman Lee Kun-hee(left) and his son Lee Jae-yong

Related:

LG to face new management centering on heir Koo Kwang-mo

For instance, Koo Kwang-mo, adopted-son of late LG Group Chairman Koo Bon-moo who passed away last week, will have to pay at least 900 billion won (US$829 million) in inheritance tax if he receives his father’s 19.46 million shares in LG Corp. The chairman’s stake is equivalent to around 1.87 trillion won

Other conglomerates, such as Samsung Group, Hyundai Motor Company, are also facing tax issues.

Samsung Group Vice Charman Lee Jae-yong, who is next in line to the throne at the nation’s largest conglomerate, in theory, needs to pay some 10 trillion won of taxes if he wants to take over the combined assets of his ailing father and Samsung Chairman Kun-hee. The senior Lee’s assets, including a 3.86 percent stake in Samsung Electronics and a 20.76 percent stake in Samsung Life Insurance, are estimated to exceed 21 trillion won in value.

Since the Samsung chairman was hospitalized after a heart attack in 2014, the business group has been relentlessly preparing for a smooth transition from father to the son, merging its affiliates, including Samsung C&T and Cheil Industries in 2015.

Hyundai Motor Group has been speeding up the power transition as well. The country’s second-largest conglomerate is expected to take one of the two following measures. In one, Chairman Chung Mong-koo hands over his entire stake in carmaker Hyundai Motors, auto parts firm Hyundai Mobis and logistics company Hyundai Glovis, which are worth 3.83 trillion won in total, to his son. In that scenario, the junior Chung will have to pay around 2 trillion won of taxes.

The country’s second largest conglomerate is also trying to push to spin off auto components maker Hyundai Mobis’ after-sales and module divisions and merge them with logistics firm Hyundai Glovis.

After the split, Chairman Chung and his son will acquire all Mobis shares held by other HMS affiliates, including Kia, Glovis and Hyundai Steel, according to HMC’s governance restructuring plan.

The move can help the family-run conglomerate simplify the current complex cross-shareholding structure with Mobis, Glovis, Hyundai Motor, and Kia Motors into the one with Mobis sitting on top. In addition, the owner family, especially the junior Chung, can also tighten his grip on HMC legitimately as he will likely have the biggest stake in the de facto holding company.

“The planned governance restructuring is aimed at strengthening Hyundai Mobis’ control over HMC’s affiliates while avoiding regulations over holding companies,” Jeon Seong-in, an economics professor of Hong-ik University, in a recent discussion session hosted by a civic group early this month.

By Kim Young-won (wone0102@heraldcorp.com)

EDITOR'S PICKS

- SK hynix chief underscores chip cooperation between Korea, US

- Trilateral talks acknowledge ‘serious’ slumps of won, yen

- Samsung C&T president makes her first business trip to Milan

- Seoul Business Agency CEO says SNS marketing essential for SME

- CJ Olive Young offers real-time translators for foreign visitors

- Hyundai Motor, Toray join hands for material innovation in mobility

- Paris Baguette debuts in the Philippines

- Samsung develops fastest DRAM chip optimzied for ondevice AI