Major Korean financial groups post decent Q1 earnings

[THE INVESTOR] Analysts said it was rough three months for Korea’s financial groups. Some have been under severe criticism due to hiring scams, triggering an unprecedented level of oversight from the country’s financial authorities. But looking at the scorecards for the first quarter, the top four major financial groups seem to have weathered the storms.

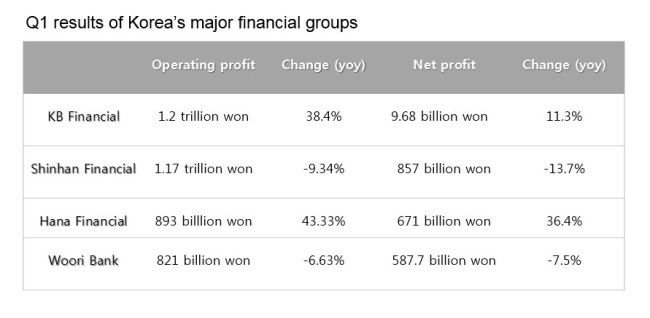

KB Financial Group, a major Korean banking group, was the first to announce its results a day earlier. Its net profit rose 11.3 percent on-year to 968.2 billion (US$912.10 million) in the first three months this year, thanks to gains in interest income and commission fees.

It’s interest income rose 15.9 percent on-year to 2.1 trillion won, while net income from commission fees increased by 20.8 percent to 628.9 billion won, the company said in a statement.

The group recorded a record 3 trillion won net profit in 2017, becoming the only financial group to reach the milestone.

Woori Bank recorded a earnings shock on April 20, with more than expected 587.7 billion won net profit backed by growth in interest margin, higher than the market consensus of 506.8 billion won. It was a 7.5 percent decrease from a year ago but excluding the one-off gains last year from its bond sales regarding the Huafu building in China, its net profit jumped 16.2 percent, the bank said in a regulatory filing.

Hana Financial Group also surprised the market with a six-year high first-quarter results. The company said on April 20 that its net profit reached 671.2 billion won, soaring 36.4 percent from a year ago. It exceeded the market expectations of 624 billion won.

The company’s net profit was backed by an increase in interest income and commission fees, which were up 12.5 percent and 20.8 percent on-year, respectively.

The last one to reveal its financial results among four major financial groups was Shinhan Financial Group on April 20. It saw a decline in its operating and net profit. The consolidated net profit was down 14 percent to 857 billion won, according to its regulatory filing. The company said it was mainly due to one-off loan loss reserves related to Shinhan Card, which cost 275 billion won. Excluding this, its net profit increased 18.9 percent.

By Park Ga-young (gypark@heraldcorp.com)

EDITOR'S PICKS

- Seoul shares rattled by Israeli attack on Iran; Kospi dips to nearly 11-week low

- S-Oil donates W560m to support firefighters

- LG CNS teams up with Yonsei University to nurture AI specialists

- Polestar 4 to make Korean debut in June

- S. Korea pledges W23tr venture capital fund for green investment at G20 meeting

- Sungsimdang outperforms bakery giants to log sales over W100b

- France rejects opening Paris flight routes to T'way Air, deals blow to Korean Air merger

- SK hynix chief underscores chip cooperation between Korea, US