Bodyfriend to choose IPO manager next week

[THE INVESTOR] Korean premium massage chair brand Bodyfriend will select the manager of its upcoming initial public offering by the end of next week, according to industry sources on Dec. 13.

Korean private equity fund VIG Partners, which acquired Bodyfriend in 2015 for 300 billion won (US$261.37 million), is currently the biggest shareholder of the massage chair producer.

The selected firm will reportedly be working with Morgan Stanley as co-IPO manager. Mirae Asset Daewoo and NH Investment & Securities are said to be strong contendors for the position.

The company earlier held the first round of discussions to choose a manager in late October. Six securities firms, including Mirae Asset Daewoo, NH Investment & Securities and Samsung Securities, participated at the time.

VIG Partners aims to obtain preliminary approval for the planned IPO during the first half of next year and go public during the second half.

“An IPO is definitely one of the options we are considering,” VIG Partners Vice President An Song-wook told The Investor.

He also denied that VIG Partners wants Bodyfriend to be listed on the benchmark KOSPI, instead of secondary bourse KOSDAQ. “Nothing has been confirmed yet,” he said.

Established in 2007, Bodyfriend is the leader in Korea’s high-end massage chair industry with a market share of around 66 percent. Its sales and operating profit in 2016 reached 366.5 billion won and 93.3 billion won, respectively.

By Song Seung-hyun (ssh@heraldcorp.com)

EDITOR'S PICKS

- [From the Scene] KG Mobility poised to take next leap

- Samsung Biologics Q1 earnings hit all-time high

- KGC eyes broader customer base with Lim Young-woong

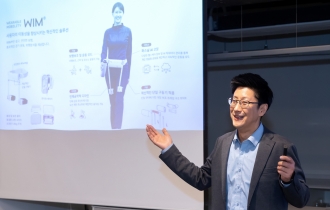

- Korean robot startup aims to transform human walking

- Coway launches Berex massage bed with enhanced usability

- Hyundai Mobis breaks ground for W170b Spain plant

- HD Hyundai teams up with Norway's Philly Shipyard for US footing

- Hanwha Life taps into global banking through Indonesian investment

![[From the Scene] KG Mobility poised to take next leap](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=141&simg=/content/image/2024/04/24/20240424050621_0.jpg)