[EQUITIES] ‘KCC’s 2 main biz enjoy boom’

[THE INVESTOR] KCC’s two flagship businesses -- construction material and paints -- are gaining from improvedng market conditions, said Shinyoung Securities on Dec. 6, raising the target price to 500,000 won (US$457.62) from 480,000 won and suggesting a “buy” recommendation.

Boosted by the rebounding paint sector, its revenue in 2018 will rise 8.1 percent on-year to 4.2 trillion won and operating profit by 12.7 percent to 400 billion won, estimated analyst Park Se-ra, adding that this is the first time since 2011 that saw both sectors are growing.

There have been concerns as its affiliate Hyundai Motor’s Chinese factory suspended operations, but KCC’s manufacturing output hiked over 20 percent in the third quarter, according to the analyst.

China’s strengthening regulation led to eco-friendly paints and some of the country’s local companies went through restructuring, while KCC’s Chinese operation gained, she explained.

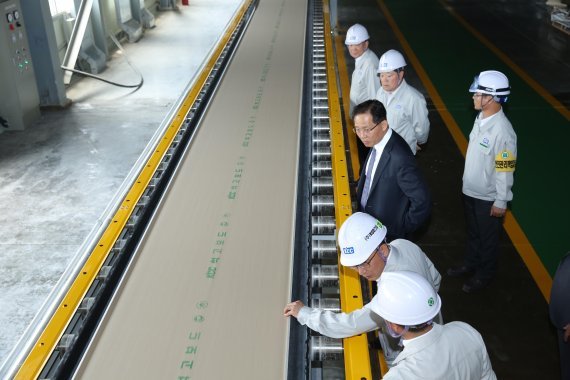

Its construction material business is headed for an upturn as it has completed expanding factories and a large number of apartments became ready, said Park. As the government has announced a welfare plan to provide 1 million public housings, the industry boom will continue well into 2019, forecast the analyst.

By Hwang You-mee (glamazon@heraldcorp.com)

EDITOR'S PICKS

- Seoul shares rattled by Israeli attack on Iran; Kospi dips to nearly 11-week low

- S-Oil donates W560m to support firefighters

- LG CNS teams up with Yonsei University to nurture AI specialists

- Polestar 4 to make Korean debut in June

- S. Korea pledges W23tr venture capital fund for green investment at G20 meeting

- Sungsimdang outperforms bakery giants to log sales over W100b

- France rejects opening Paris flight routes to T'way Air, deals blow to Korean Air merger

- SK hynix chief underscores chip cooperation between Korea, US