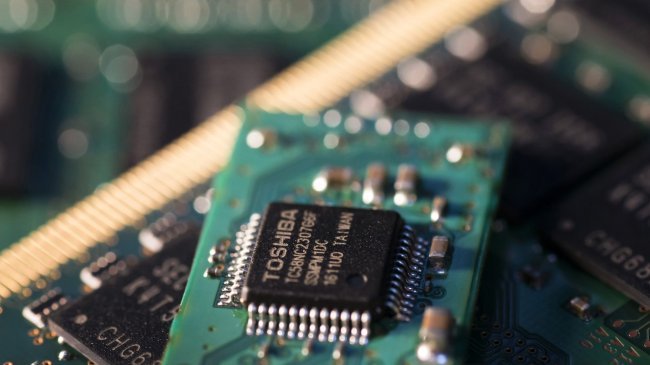

Toshiba re-picks global consortium for negotiations

[THE INVESTOR] Japan’s Toshiba is reconsidering a global consortium that includes South Korea’s SK hynix to hand over its memory chip business, the company announced on Sept. 13.

Toshiba’s board of directors decided to sign a memorandum of understanding with the consortium led by US private equity group Bain Capital and technology giant Apple, Development Bank of Japan and Korean chipmaker SK hynix, in the next few days.

“Toshiba‘s board of directors has determined to continue negotiations with the Bain-led consortium on the basis of this new proposal, and the company will work to expedite the conclusion of a stock purchase agreement by the end of September,” the Japanese company said in a press release.

However, such a memorandum is not legally binding, the company underscored, saying, “It has entered into a nonbinding memorandum of understanding with Bain. The signing of this does not eliminate the possibility of negotiations with other consortia.”

The other consortia here refers to a group led by the US’ Western Digital and another led by Taiwan’s Hon Hai.

The Bain-led group was picked as a preferred bidder in June to buy the Toshiba chips unit, but negotiations haven’t proceeded well in the last two months due to opposition from Toshiba’s longtime partner and the consortium’s rival Western Digital.

Speculation had risen until last month that Western Digital would be a final bidder to take over the Toshiba unit, considering their yearslong partnership and a closed-door meeting between the chiefs of the two companies on the ongoing talks.

The situation quickly changed last week, as the Bain-led consortium proposed an additional financial investment plan to Toshiba, according to news reports.

In addition to the acquisition price of 2 trillion yen ($18.2 billion), the group decided to offer 400 billion yen for research and development for the Toshiba unit as a final proposal.

Bain and SK hynix are said to be providing a total of 567.5 billion yen, while Apple is said to offer 335 billion yen. The Japanese bank is providing loans worth 600 billion yen. The remainder is likely to be covered by several Japanese and US tech companies in the group.

“Nothing has been confirmed yet, and we have no comment on the going talks,” said an SK hynix official.

For SK hynix, the ongoing talks do not seem positive, considering the Korean chipmaker had an ambition to a stake in Toshiba’s memory chip business specializing in 3-D NAND flash.

According to the consortium’s final proposal, Bain is to own 49.9 percent of the chips unit, while Toshiba retains 40 percent. The remaining 10.1 percent is forecast to be owned by a Japanese entity.

Such an ownership plan is set by Toshiba’s management as a maneuver to get approval from the Japanese government by easing concerns about technology leaks to foreign businesses and management intervention.

By Song Su-hyun/The Korea Herald (song@heraldcorp.com)

EDITOR'S PICKS

- LG Chem eyes new leap into top science company

- Korea enters clear growth path as Q1 growth hits 2-year high

- Hyundai, Kia seek to boost presence in China market

- 7 out of 10 wealthy Koreans offer grim outlook for 2024

- [KH Explains] Korean shipbuilding stocks rally: Real growth or bubble?

- [Hello India] Hyundai Motor vows to boost 'clean mobility' in India

- Eximbank to nurture regional development specialists

- [From the Scene] KG Mobility poised to take next leap

![[KH Explains] Korean shipbuilding stocks rally: Real growth or bubble?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=141&simg=/content/image/2024/04/25/20240425050656_0.jpg)

![[Hello India] Hyundai Motor vows to boost 'clean mobility' in India](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=141&simg=/content/image/2024/04/25/20240425050672_0.jpg)

![[From the Scene] KG Mobility poised to take next leap](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=141&simg=/content/image/2024/04/24/20240424050621_0.jpg)