Celltrion Healthcare clears concerns over accounting flaws

The Securities and Futures Commission of the Korea Exchange, the country’s bourse operator, decided on July 21 to impose a warning, the lowest disciplinary action, to Celltrion Healthcare for overcalculating earnings from one of its drug Truxima, by 8 billion won (US$7.01 million) in 2015.

Related:

5 things to know before Celltrion Healthcare’s IPO

The decision eases concerns that Celltrion Healthcare’s IPO could be delayed if the SFC slapped stronger penalties, which could have led to a new preliminary review for listing on the KOSDAQ market.

Prior to the regulator’s conclusion, the Korean Institute of Certified Public Accountants, which inspects the financial records of unlisted firms, conducted an in-depth audit of Celltrion Healthcare’s accounting practices from March.

Having cleared the financial accounting woes, the company and IPO underwriters will be in full swing to ensure a successful market debut by launching an investor roadshow in New York, San Francisco, London, Hong Kong and Singapore for two weeks from July 3.

Celltrion Healthcare, which owns the exclusive rights to market, sell and distribute Celltrion’s biosimilar drugs, aims to raise up to 1 trillion won from its share sale. It will sell 24,604,000 new shares at an indicative price range of 32,500 won to 41,000 won.

By Park Han-na (hnpark@heraldcorp.com)

EDITOR'S PICKS

- [From the Scene] KG Mobility poised to take next leap

- Samsung Biologics Q1 earnings hit all-time high

- KGC eyes broader customer base with Lim Young-woong

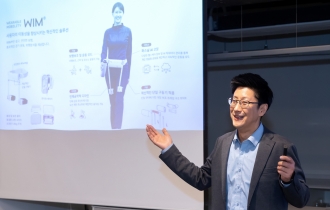

- Korean robot startup aims to transform human walking

- Coway launches Berex massage bed with enhanced usability

- Hyundai Mobis breaks ground for W170b Spain plant

- HD Hyundai teams up with Norway's Philly Shipyard for US footing

- Hanwha Life taps into global banking through Indonesian investment

![[From the Scene] KG Mobility poised to take next leap](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=141&simg=/content/image/2024/04/24/20240424050621_0.jpg)