Amorepacific stocks surge despite gloomy Q1 estimates

[THE INVESTOR] Amorepacific shares continued their winning streak despite bleak market forecasts for first-quarter earnings.

On April 21, Amorepacific Corp. ended 3.59 percent higher at 317,500 won, and Amore Group (AmoreG) closed up 4.09 percent at 140,000 won. Over the past week, these two stocks both rose more than 10 percent.

The gains came despite pessimistic estimates by analysts for their earnings results which will be announced on April 24. According to financial information provider WISEfn, the market consensus for Amorepacific Corp.’s quarterly operating profit is 336.1 billion won (US$294.59 million).

This is down 9.51 percent from the estimates three months ago, and 3.9 percent lower than a month ago. AmoreG’s operating profit was estimated at 414.5 billion won, down 11 percent and 3.7 percent from three months and a month ago, respectively.

Analysts cut their forecasts amid escalating diplomatic tensions between Korea and China following the decision to deploy US-led THAAD missile system. They warned that business risks involving China would become visible in the second quarter.

“Although growth remains robust in absolute terms, we expect the market to adopt a wait-and-see approach toward (Amorepacific) for some time, given a decline in the growth momentum and doubts about second-quarter results,” said Park Eun-kyung, an analyst at Samsung Securities.

Local companies including cosmetics makers appear to be suffering from Beijing’s measures to deter Seoul from deploying THAAD.

However, investors seem to take some comfort from better-than-expected exports of the overall cosmetics industry. In the first three months, exports jumped 32.1 percent to US$935 million from a year ago, according to data compiled by the Korea Customs Service on April 20.

Exports to China rose 26.7 percent on-year to US$337 million during the same period. The figure cleared some concerns over China’s retaliatory moves on Korean businesses.

Behind the gains of Amorepacific shares were institutional investors and foreign investors. Institutional investors continued their buying spree for four consecutive days while foreign investors remained net-buyers for three straight days. The benchmark KOSPI added 1.2 percent during the week ending April 21.

By Park Ga-young (gypark@heraldcorp.com)

EDITOR'S PICKS

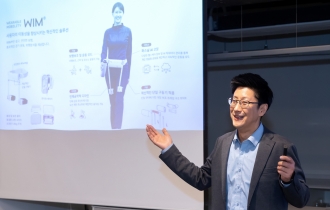

- [From the Scene] KG Mobility poised to take next leap

- Samsung Biologics Q1 earnings hit all-time high

- KGC eyes broader customer base with Lim Young-woong

- Korean robot startup aims to transform human walking

- Coway launches Berex massage bed with enhanced usability

- Hyundai Mobis breaks ground for W170b Spain plant

- HD Hyundai teams up with Norway's Philly Shipyard for US footing

- Hanwha Life taps into global banking through Indonesian investment

![[From the Scene] KG Mobility poised to take next leap](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=141&simg=/content/image/2024/04/24/20240424050621_0.jpg)