[STOCK WATCH] Interpark falls 2%

Target price 15,100 won, has 34% disparate to increase compared with stock price. Per analysts' expectations during the recent month, the average target price of Interpark is 15,100 won. The stock price is 11,250 won as of yesterday, so there is 3,850 (34%) won disparate in order to be able to increase.

Yesterday, institutions and foreigners bought 165 shares and 17,813 shares. As a shareholding sum by investor group for the past 4 weeks, foreigners have sold 26,684 shares and institutions have sold 91,864 shares with a selling trend. However, during the same period, individuals have bought 118,548 shares with an increasing position. Turnover Rate and Price Range both proper Regarding the statistics for the past month on trade volume as the total outstanding shares, the daily turnover rate of Interpark was 0.15%. And the daily volatility, the average range of rise and fall, during the same period is 3.93%. Participation of Foreigners is active, 32.53% As per the inquiry for shareholding by investor group, the major investor group is Individuals with 58.11% from total outstanding shares. Foreigners and institutions each hold 32.53% and 9.35%. And as recent 5-day shareholding change by investor group, individuals is the major investor group with 51.64%. Foreigners hold 38.93% and institutions hold 9.42%.

By HeRo (hero@heraldcorp.com) This article is produced by the algorithm developed by the artificial intelligence developer ThinkPool in collaboration with Herald Corp. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

EDITOR'S PICKS

- [From the Scene] KG Mobility poised to take next leap

- Samsung Biologics Q1 earnings hit all-time high

- KGC eyes broader customer base with Lim Young-woong

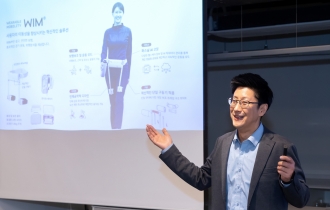

- Korean robot startup aims to transform human walking

- Coway launches Berex massage bed with enhanced usability

- Hyundai Mobis breaks ground for W170b Spain plant

- HD Hyundai teams up with Norway's Philly Shipyard for US footing

- Hanwha Life taps into global banking through Indonesian investment

![[From the Scene] KG Mobility poised to take next leap](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=141&simg=/content/image/2024/04/24/20240424050621_0.jpg)